Skyrocketing values mean higher tax bills

Last updated 10/1/2019 at Noon

Dave Rogers

For The Record

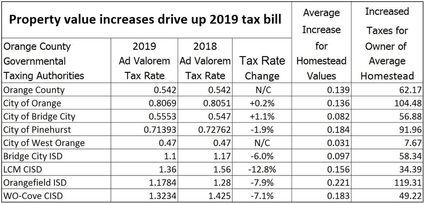

The good news for Orange County folk who follow local meetings is that the tax rates went down for most property owners.

The bad news is coming to your mailbox at the end of the month.

That’s when Karen Fisher, Orange County Tax Assessor-Collector, sends out the 2019 tax statements telling how much taxpayers owe all the entities in which they live.

The owner of an “average homestead” can add more than $200 to last year’s bill in new county, city and/or school district taxes.

Of course, last year’s property values were lowered because of all the damage done by Tropical Storm Harvey in 2017.

Generally, tax rates were raised to make up for the low rates.

So property values rebounded as expected.

The average value of homes in Orange County are up 13.9%. Homesteads in the Orangefield school district are worth 22.1% more than a year ago, according to the values assessed by the Orange County Appraisal District.

Schools across Texas were awarded $11.6 billion by the Texas Legislature in May to both help education and offer property tax relief.

To accomplish the latter, districts were forced to lower their tax rates.

While school districts in Bridge City and Little Cypress-Mauriceville lowered their rates by seven cents and 20 cents per $100 assessed value, respectively, they had little choice.

To go a fraction of a penny higher would force a rollback election, letting the schools’ patrons vote on the tax rate.

Fisher, who just got back from a conference on new laws, mentions the Legislature has replaced “rollback rate” with new language.

“It’s a ‘voter approved tax rate,’” she said.

City and county governments are getting some new restrictions next year, thanks to Senate Bill 3.

While counties and cities could raise their taxes as high as 8% above the effective tax rate without voter consent in the past, starting next year, they can only go 3.5% above the rate needed each year to yield the same amount of revenue as the previous year.

Schools, which had been allowed to raise rates up to 5%, now can only go 2.5% without taxpayers getting involved.

“We’re going to be in for a surprise next year,” Fisher said, referring to Senate Bill 2. “The new law will be tough on all the entities. That just allows them to get the cost of living.”

The city of Orange took the full 8% in raising its tax rate, though the rate just went up less than two-tenths of a cent from 80.51 cents per $100 value to 80.69 cents per $100 value.

But its effective tax rate was 75.15 cents per value and its rollback rate was 80.691.

“This [SB 2] is something that will have decades of impact,” Kelvin Knauf, Orange’s acting city manager through the end of September, said in an August workshop, referring to fears across the state that the new law will hamper local governments’ ability to provide vital services.

“I say our goal should be to go up 7.99 percent this year, and not leave anything.”

Mission accomplished.

The average homestead value in the City of Orange, which means after exemptions, went up 13.6% for 2019 and the tax bill for the average house will go up $104.48, just with city taxes.

Average homestead values depend where you live, of course.

Bridge City ISD has the highest 2019 homestead values in Orange County at $134,779. West Orange-Cove CISD has the lowest, at $41,426.

Homestead values rose only 3.1% in the City of West Orange; the average homestead is taxed at $53,426 and with the tax rate staying same as last year – 47 cents per $100 – the owner of that average home will see only $7.67 added to his city taxes.

Reader Comments(0)